糾結均線代表的是短中長期持股者的成本都接近一致,一旦突破,賣壓很輕,同樣的道理,一旦跌破,代表短中長期的持股者大家都同時被套牢,這種情況會造成,股價一旦反彈,馬上就會面臨極大的賣壓,所以跌破糾結均線,是可信度極高的波段空頭策略,特別是對那些長期不大賺錢的大型股,更是如此。

跌破糾結均線的腳本,跟突破糾結均線的腳本差不多

1if GetSymbolField("tse.tw","收盤價") 2<average(GetSymbolField("tse.tw","收盤價"),10) 3then begin 4 5input: shortlength(5); setinputname(1,"短期均線期數"); 6input: midlength(10); setinputname(2,"中期均線期數"); 7input: Longlength(20); setinputname(3,"長期均線期數"); 8input: Percent(5); setinputname(4,"均線糾結區間%"); 9input: XLen(20); setinputname(5,"均線糾結期數"); 10 11input: Volpercent(25); setinputname(6,"放量幅度%");//帶量突破的量是超過最長期的均量多少% 12variable: shortaverage(0); 13variable: midaverage(0); 14variable: Longaverage(0); 15variable: AvgHLp(0),AvgH(0),AvgL(0); 16 17shortaverage = average(close,shortlength); 18midaverage = average(close,midlength); 19Longaverage = average(close,Longlength); 20 21 22AvgH = maxlist(shortaverage,midaverage,Longaverage); 23AvgL = minlist(shortaverage,midaverage,Longaverage); 24 25if AvgL > 0 then AvgHLp = 100*AvgH/AvgL -100; 26 27condition1 = trueAll(AvgHLp < Percent,XLen); 28condition2 = V > average(V[1],XLen)*(1+Volpercent/100) ; 29condition3 = average(Volume[1], 5) >= 2000; 30condition4 = C < AvgL *(0.98) and L < lowest(L[1],XLen); 31 32ret = condition1 and condition2 and condition3 and condition4; 33end;

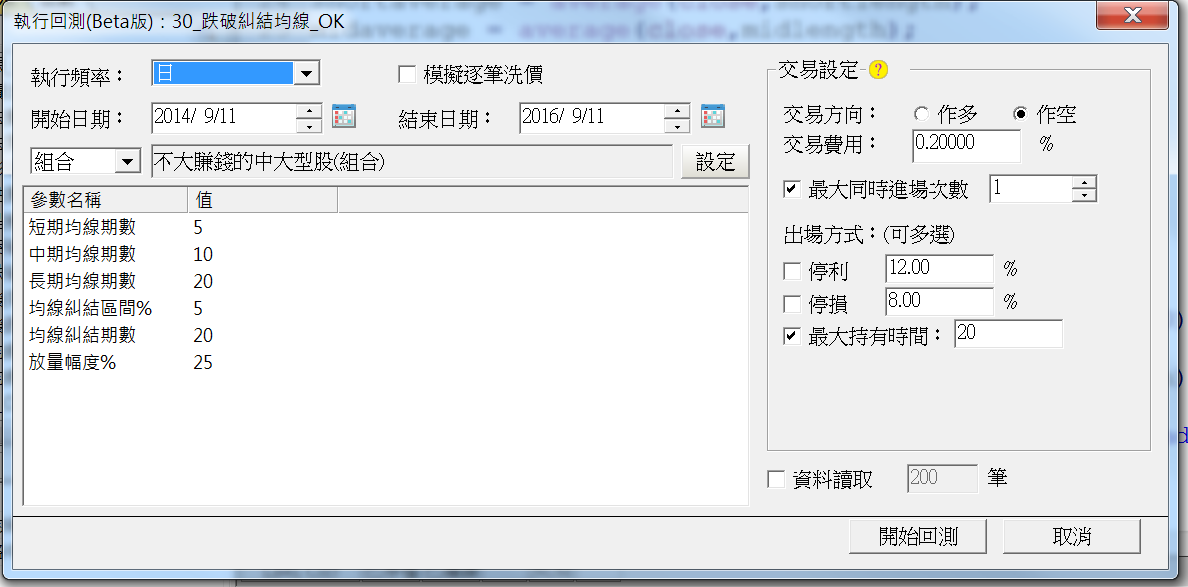

不過在回測設定時,我用的是不大賺錢的大型股,出場是進場後二十天後

回測報告如下

我們可以看得出來,這是一個勝率超過六成的波段作空策略